Healthcare Horizons

Hospital M&A: 3 Reasons to Know Your HHI

The new federal standard for hospital mergers … is that there is no standard. With the DOJ now promising a “case-by-case enforcement approach,” healthcare leaders will need to defend their affiliation strategy with a mix of numbers and narrative.

By Dawn Carter

On Feb. 3, 2023, the Justice Department lobbed a hand grenade into the healthcare market by withdrawing Clinton-era policy guidelines that had created an “antitrust safety zone” for most hospital M&A activity. Rather than issuing new guidelines, DOJ simply declared that it would take “a case-by-case enforcement approach … to better evaluate mergers and conduct in healthcare markets that may harm competition.”

In criminal law, the U.S. standard has always been “innocent until proven guilty.” In a way, the Clinton guidelines extended that principle to healthcare mergers by specifying the types of deals that were presumed to pass muster, absent any “extraordinary circumstances.” If you were a small hospital – and a rural hospital, in particular – you didn’t have much worry that the Justice Department might sue to block your merger plans.

The strategy advisors at Ascendient have been doing hospital M&A for 20 years, often working with smaller providers that desperately need greater resources in order to survive and thrive. In those engagements, we were guided by the Statements of Antitrust Enforcement Policy that were published in 1996.

Now that those guidelines have been scrapped, the process of winning approval for any sort of hospital affiliation could look very different.

States, too, are threatening to take a more active role in reviewing healthcare mergers. Minnesota, North Carolina, and Washington all have pending bills that could reduce merger activity through new regulatory hurdles and higher costs. Indiana and Oregon recently passed more restrictive merger laws, though the state healthcare association in Oregon has sued over alleged vague terms in the statute.

In justifying a more restrictive stance toward hospital M&A, both federal and state regulators inevitably cite competition and concentration. Conventional wisdom holds that the two forces are inversely related, with mergers driving concentration up and competition down. It’s almost like a see-saw: When merger activity goes up, competition must come down.

But in the convoluted world of healthcare strategy, nothing is that simple.

Say “Hi” to HHI

Everyone who deals with hospital M&A has heard of the Herfindahl-Hirschman Index (HHI), though it’s usually just reported as a numerical score with little understanding of the contributing factors – much less what the score really means.

Here’s a quick primer.

HHI measures consolidation or concentration by looking at the number of competitors in a market and their relative strength. Scores range from 0 (perfect competition) to 10,000 (perfect monopoly). When you have many businesses with relatively equal market share, the HHI score will be lower, indicating more competition. When you have fewer businesses – or when market share is heavily skewed toward one or two market leaders – the HHI score will be higher, indicating greater concentration.

Per the U.S. Department of Justice, market concentration scores fall into three bands:

- Unconcentrated markets: HHI < 1,500

- Moderately Concentrated markets: HHI 1,500 – 2,500

- Highly Concentrated markets: HHI > 2,500

The math for creating an HHI score looks deceptively simple: Square the market share of each competitor, then add all the squares. So, in a community where 4 competitors each have 25% market share, HHI is a “moderate” 2500 (252 + 252 + 252 + 252).

The problem is that both “community” and “market share” can be defined in many ways. The most-cited HHI scores, published by the Health Care Cost Institute, are based on inpatient admissions as calculated by a sample of insurance claims in communities defined by “patient flow” rather than strict geographic boundaries.

HCCI’s full, 26-page Technical Appendix is available here, but it’s not terribly helpful for healthcare leaders who want to articulate a position on competition and concentration. Instead, let’s look at actual, publicly available numbers from Atlanta. In this example, community boundaries will be all Zip codes within the Atlanta MSA, and we’ll define market share by number of beds.

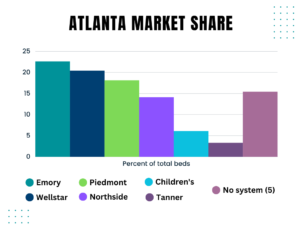

Using those definitions, Atlanta is a Moderately Concentrated market with an HHI of 1608. There are a total of 10,508 beds operated by six systems and five independents. That’s a good number of competitors, but the distribution of their market share is far from even – a recipe for elevated HHI.

Emory, the largest system, controls about 23% of available beds, while Tanner, the smallest system, controls about 3%. (Note that HCCI also lists Atlanta as Moderately Concentrated, though the exact HHI is 2085 due to the difference in inputs. However you choose to define market and market share, outcomes will be directionally similar.)

With that example in mind, there are three key things to know about the Herfindahl-Hirschman Index – three legitimate reasons to challenge the conventional wisdom on hospital mergers.

1. Mergers Aren’t the Only Cause of Concentration

Almost by definition, market concentration as measured by HHI will increase in the wake of a hospital merger (with one major exception that I’ll note below). But the outright closure of a vulnerable hospital will also trigger an increase in HHI, and the repercussions can be worse than a merger.

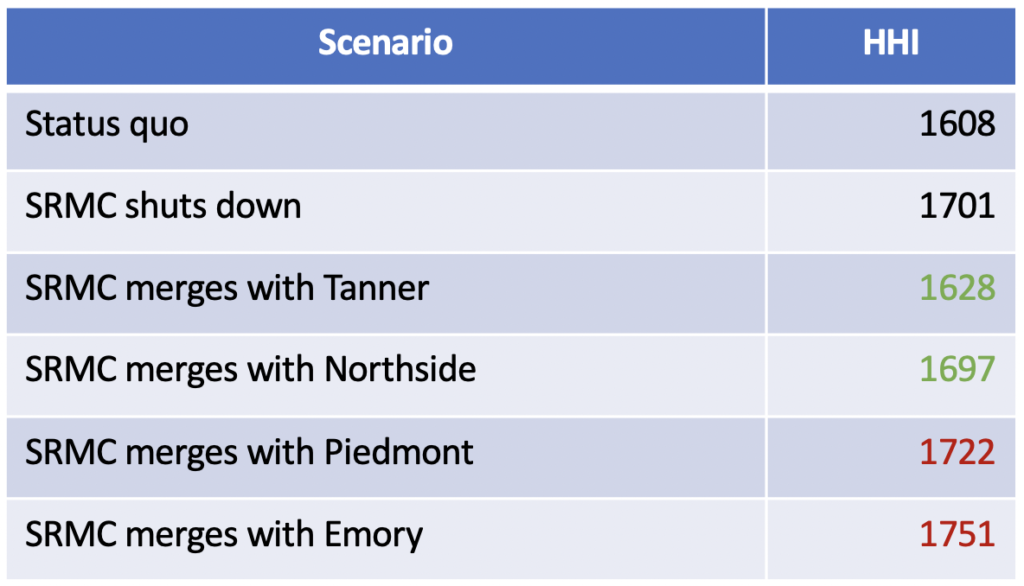

Take another look at the Atlanta market, which was rocked by Wellstar’s closure of Atlanta Medical Center in 2022. What would happen if another hospital were to shut its doors – say, Southern Regional Medical Center (SRMC)? With 331 licensed beds and razor-thin margins of just 0.2%, it’s not inconceivable that California-based Prime Healthcare would want to weigh the options for its lone nonprofit hospital in Georgia.

If SRMC were to shut down entirely, similar to Atlanta Medical Center, then market concentration as measured by our HHI model would shoot up by nearly 100 points, even with no M&A activity. That’s not unusual; it’s simply the way HHI works. When any community loses a hospital, all remaining providers will find themselves with a bigger share of the pie, and the market becomes more concentrated, by definition.

That’s not a story that gets told often enough. For healthcare leaders in search of strategic partners but worried about regulatory pushback, it’s important to understand the data and then to articulate how a closure would affect competition.

Here’s another twist to the story: In many cases, a merger between two providers actually creates lessconsolidation than the outright closure of one hospital. You can see that dynamic at work in the Atlanta example.

If market concentration is truly the enemy, then two different merger possibilities (Tanner and Northside) would be better than allowing SRMC to close its doors. That is, the post-merger HHI would be lower than 1701, so a merger would result in less concentration than a closure. Yes, Tanner or Northside would gain market share as acquirers, but those gains would come at the expense of the largest systems, so overall concentration would still fall short of the “shutdown” scenario.

One final storyline is worth noting here. If larger systems like Piedmont or Emory were allowed to merge with SRMC, then the market would indeed become slightly more concentrated – but the keyword is “slightly.” Compared to shutting down SRMC entirely, a merger with Emory increases HHI by about 3%, while a Piedmont merger increases HHI by barely 1%.

What’s the actual cost of a 1% or 3% increase in market concentration? I’m not sure there’s any way to answer that, because there’s still no reliable formula linking competition and prices in healthcare. On the other hand, there are dozens of ways to state the cost of closing down a hospital – lost jobs, decreased tax revenue, inequitable access, negative health outcomes, and more.

When hospital M&A decisions are framed in those terms, maybe concentration isn’t the biggest threat, after all.

2. Rural Markets Are Different

After decades of experience in hospital M&A, we find that HHI is particularly ill-suited to rural healthcare markets. While urbanites typically have their pick of competing hospitals, rural residents are sometimes lucky to find a single hospital bed within a 30-minute drive. That means rural healthcare, almost by definition, is concentrated rather than competitive – and a hospital closure can make the situation much worse.

For instance, Ascendient worked recently with Hospital Z, an independent rural facility that was facing closure after years of financial distress. The most logical buyer – we’ll call them System A – operated several hospitals across the three-county MSA and enjoyed a 69% market share. Two other systems had only a few beds in the community, resulting in a “highly concentrated” HHI of 5164.

After extensive due diligence, System A decided against an acquisition for several reasons, including the prospect of a long and expensive legal battle over excess concentration in the market. It’s true that the proposed acquisition would have increased consolidation by 21% (a new HHI of 6275), but here’s the irony: Closing Hospital Z completely would have been nearly as bad for competition, with a 17% increase in market concentration.

Closure was a very real possibility in this situation. Other, more distant in-state systems could have sailed through regulatory scrutiny, but those systems weren’t interested in taking on the financial burden of Hospital Z. A merger only made financial sense for System A because its geographic proximity would help to attract more patients for tertiary services.

In the end, an out-of-state, for-profit operator bought Hospital Z after the county kicked in tens of millions of dollars in incentives. For now, residents still have nearby inpatient services, but the hospital continues to struggle financially.

This is a case where a rural county nearly lost its only hospital – and its largest employer – due in part to the bogeyman of market concentration. It’s doubtful that a few more rural beds would have greatly increased the pricing power of System A, which is one of the smaller systems in the state. But there’s absolutely no doubt that a closure would have been disastrous for county residents.

We believe a larger risk-reward analysis is needed for rural hospital mergers. Regulators need to look beyond a simplistic number like HHI when a rural hospital’s survival is at stake – and hospitals need to be prepared with a larger narrative about health outcomes and economic impacts if a blocked merger force them to close their doors.

Incidentally, there is federal precedent for a more relaxed approach to competition. Congress appropriates more than $300 million a year to subsidize commercial air service by a single airline in hundreds of rural communities. The Essential Air Service (EAS) program recognizes that air travel is key to economic development, so lawmakers and regulators prioritize access over competition.

Every EAS community would score 10,000 on the Herfindahl-Hirschfeld Index – a perfect monopoly – yet consolidation is not only tolerated, but subsidized. Are airlines somehow more “essential” than hospitals?

3. HHI Encourages Distant Ownership

One way that health systems may avoid intense regulatory scrutiny is with a cross-border merger, like the 2022 tie-up between Advocate Aurora and Atrium. Despite the size and scope of that deal – six states, 67 hospitals, and $27 billion in revenue – the FTC decided not to intervene.

Why? Because the two health systems are hundreds of miles apart, and current FTC guidelines are focused on maintaining competition for patients within the same geographic market. According to the regulatory logic, if two health systems don’t overlap geographically, then there’s no harm in a merger because there’s no effect on competition – patients still have exactly the same number of choices within their market.

Going back to our Atlanta example, we’ve already seen that any hospital M&A activity among current competitors will increase concentration. Even a small acquisition, like 331-bed Southern Regional, would increase Atlanta’s HHI by about 100 points, while a major tie-up between market leaders Wellstar and Emory would send HHI soaring 900 points. Regulators would likely try to block that deal.

But let’s say an out-of-market giant like Texas Health (3428 beds) decided to buy Emory, with its 2376 beds. Despite the size of the merger, provider concentration in the Atlanta market wouldn’t budge, because HHI can’t measure cross-border transactions. From an antitrust standpoint, Atlanta would still have the same level of competition – even though it would lose local decision-making over nearly one-quarter of its hospital beds.

Keeping healthcare as local as possible is a value that state regulators, in particular, might appreciate. By understanding how HHI encourages out-of-state mergers, healthcare leaders have yet another compelling storyline to defend their affiliation strategy.

Conclusion

It’s unfortunate that the Herfindahl-Hirschman Index is such a blunt tool for evaluating hospital M&A decisions. For hospitals and health systems considering affiliation at any level – merger, joint venture, management contract, etc. – data is just one piece of the puzzle. As more regulators take a hostile stance and demand that hospitals justify their affiliation strategy, you need to go beyond the data to tell a compelling story about healthcare in your community, both today and tomorrow.

Numbers and narrative are two sides of the same coin. In today’s environment, you’ll need to master both to successfully close a hospital M&A transaction.

Sometimes a merger is the key to effective, equitable, and sustainable healthcare for local communities. If your hospital is exploring its options, we’d love to help. Click here to learn more about our M&A practice, or contact us to start the conversation.

[cta 1]

Comments