What Hospitals Need to Know About Medicare Advantage Growth

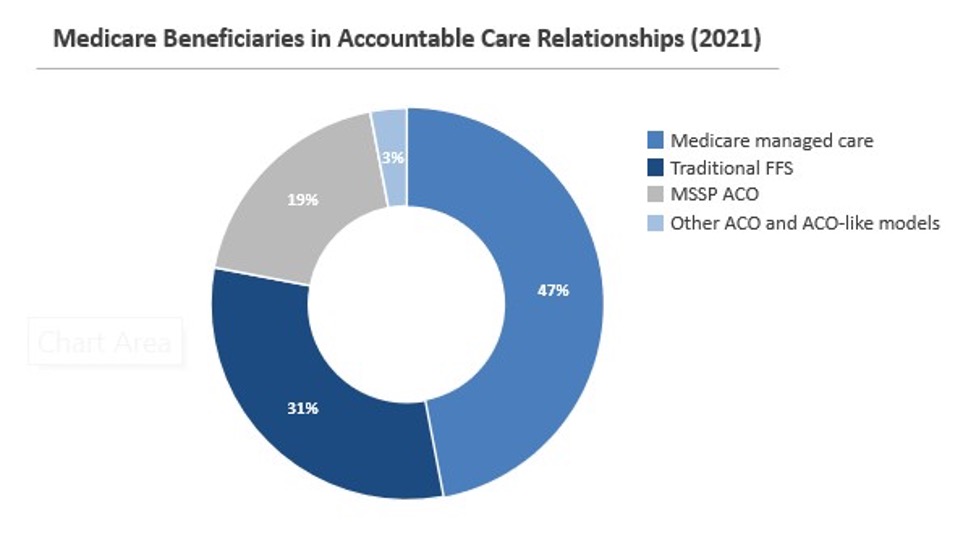

With Medicare Part A facing insolvency as early as 2026, CMS is looking to make dramatic moves. The CMS Innovation Center is aiming to have 100 percent of Medicare beneficiaries in some sort of accountable care relationship by 2030 – a shift that would have major revenue implications for hospitals and health systems.

A closer look at the data reveals that this goal is not so far-fetched, largely due to consistent Medicare Advantage growth. As shown in the chart below, less than a third of Medicare beneficiaries were still in a traditional fee-for-service relationship in 2021. CMS considered the other 69 percent of Medicare beneficiaries to be in an accountable care relationship already as they were attributed to either a Medicare Advantage plan or value-based model like an ACO.

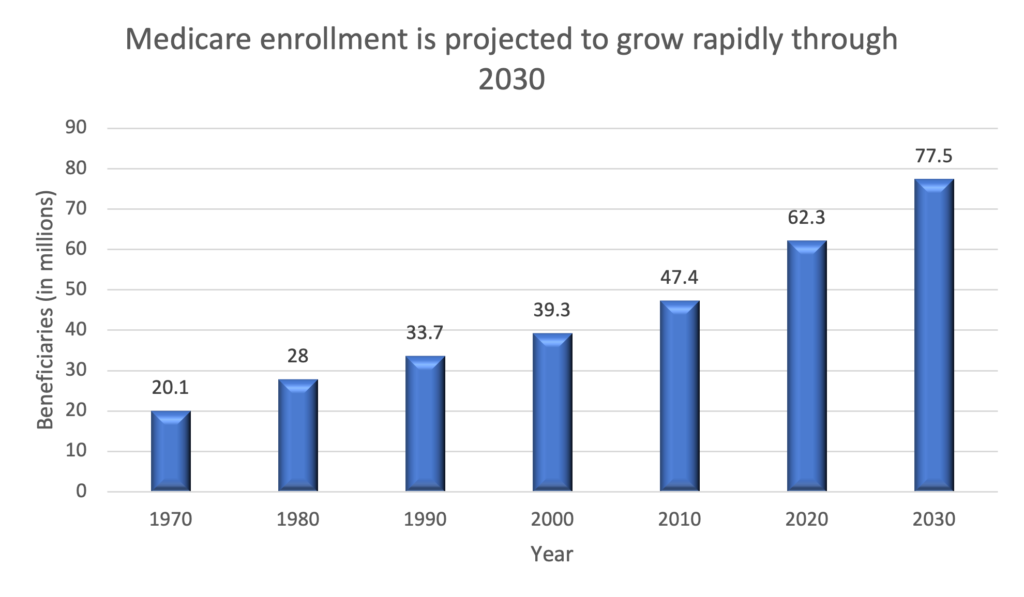

Medicare Advantage makes up the largest share by far, and enrollment has increased more than fivefold since 2003. As more baby boomers become eligible, overall Medicare enrollment will quickly reach about 78 million in 2030, a 26 percent increase in just ten years, according to MedPAC. Based on recent trends, roughly half of these new enrollees will choose a Medicare Advantage plan, and based on experience, many won’t spend their money or utilize healthcare services the same way Medicare beneficiaries have in the past.

Medicare Advantage plans incentivize primary care through lower out-of-pocket costs and/or restrictive policies on advanced care. Not surprisingly, then, a recent study by the Better Medicare Alliance found that high-need, high-cost Medicare Advantage populations utilize healthcare services differently than identical enrollees in traditional Medicare: Medicare Advantage patients were 21 percent more likely to utilize outpatient services and 10 percent less likely to be hospitalized than traditional Medicare patients.

With lower utilization, inpatient costs for the high-need, high-cost Medicare Advantage population are 13 percent lower than the identical traditional Medicare population. Regardless of the Medicare population’s health status, Medicare Advantage generally pays, on average, 8 percent less than traditional Medicare, according to Health Affairs.

Add it all up, and Medicare Advantage growth could pose a threat from all sides to hospital revenue: lower inpatient charges for high-need populations, plus lower reimbursements across the board, compared to traditional Medicare.

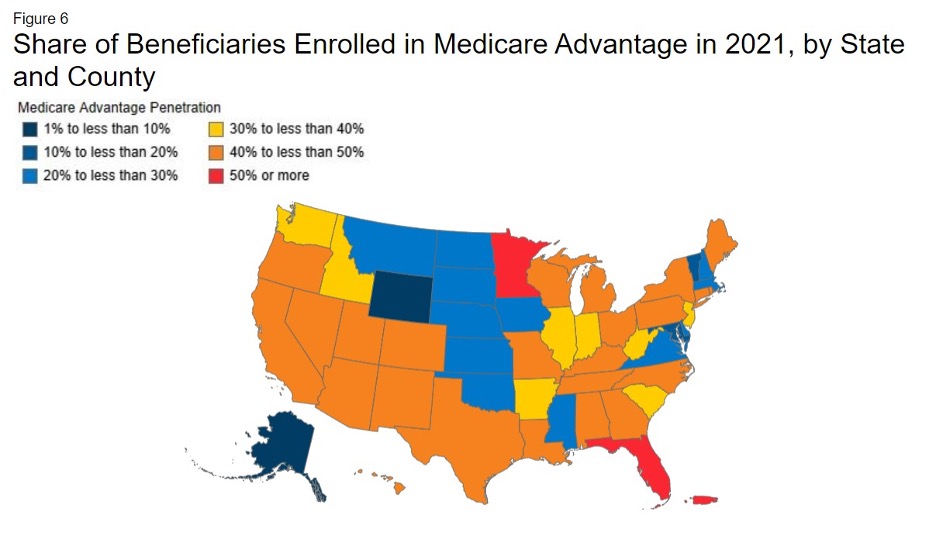

On a statewide basis only Minnesota and Florida (as well as Puerto Rico) currently have Medicare Advantage enrollments greater than 50 percent of beneficiaries. In the other 48 states that still skew toward Medicare fee-for-service, hospitals and health systems likely have not experienced – or anticipated – the reduction in revenue that is likely to come from sharply higher Medicare Advantage growth in the near future. [1]

If you’re a healthcare leader in a high fee-for-service market, the trend line was already signaling trouble ahead. But now, with the aggressive new goal of 100% accountable care for Medicare enrollees, CMS is bending the curve even more sharply, and it’s time to re-think your revenue assumptions going forward.

In the not-so-distant future, a hospital-focused strategy will be ineffective and costly. As these Medicare Advantage trends show, care will increasingly be delivered in alternative locations and focused on prevention and primary care. Health systems that are not investing in alternative business models now will likely face significant difficulties as these shifts accelerate.

[1] Map credit: KFF analysis of March Medicare Enrollment Dashboard, 2021

Comments